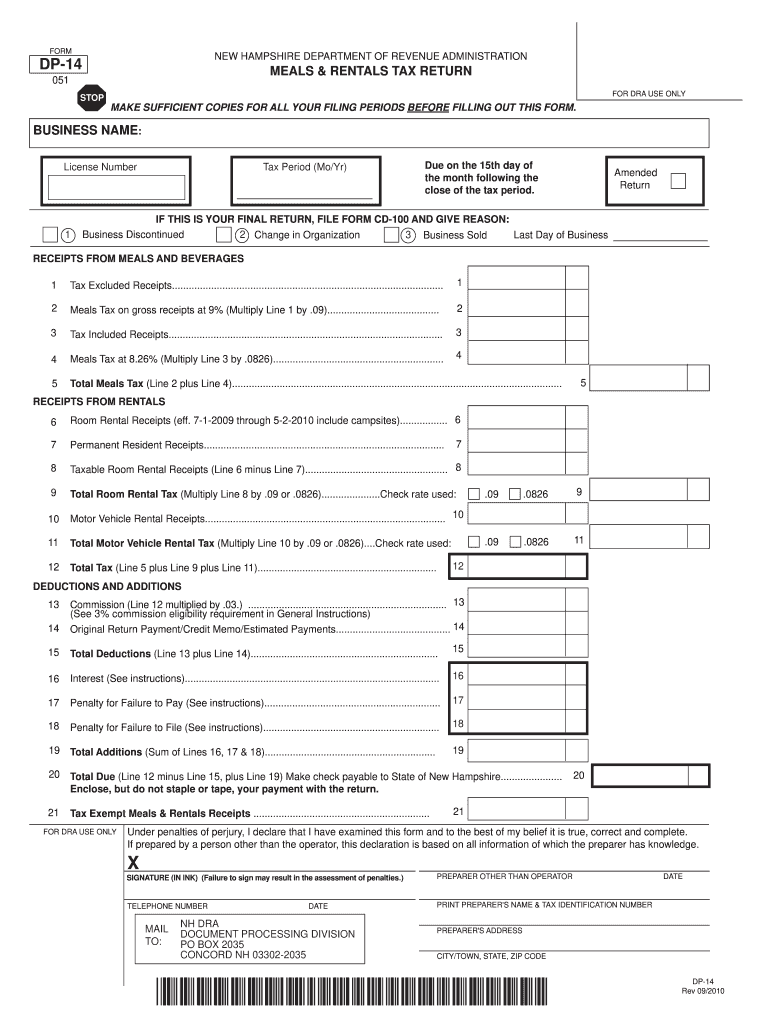

nh meals tax form

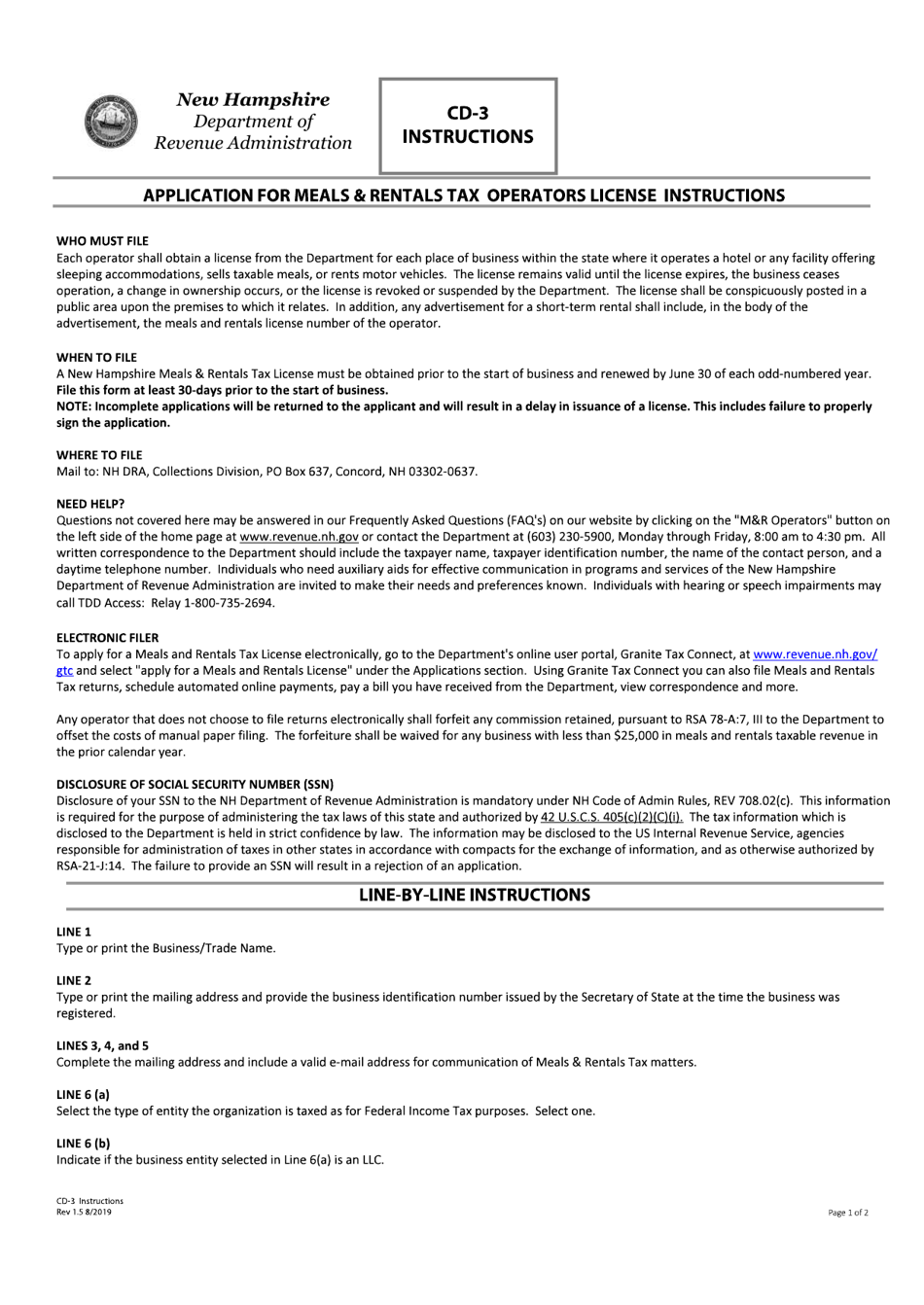

A New Hampshire Meals Rentals Tax License must be obtained prior to the start of business and renewed by June 30 of each odd-numbered year. A 9 tax is also assessed on motor vehicle rentals.

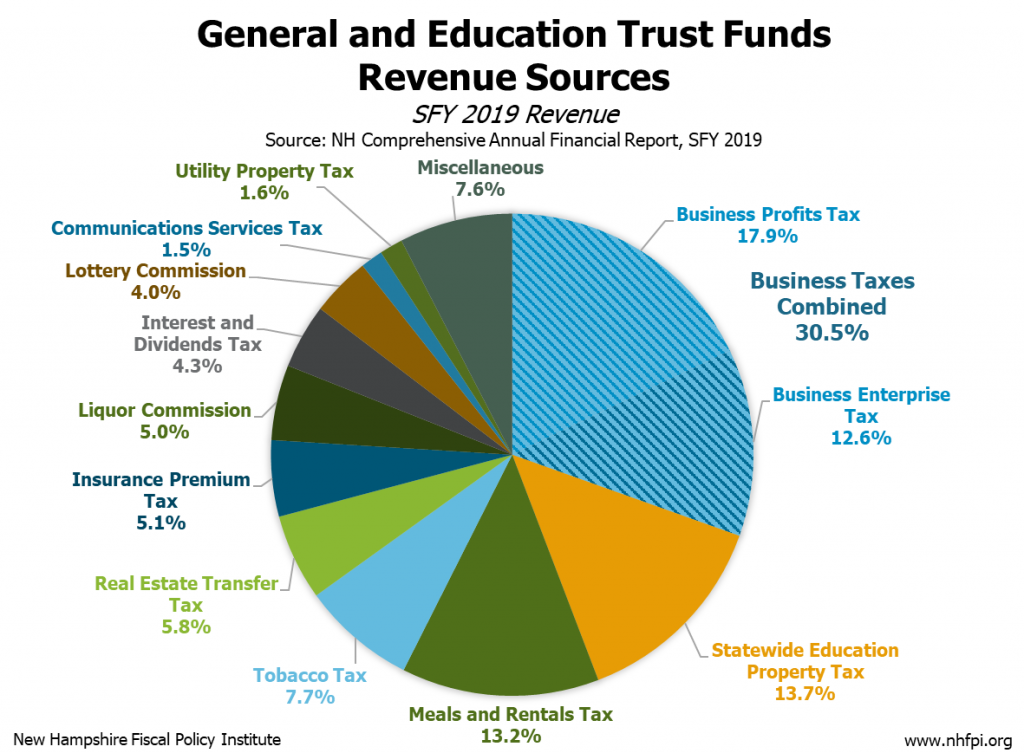

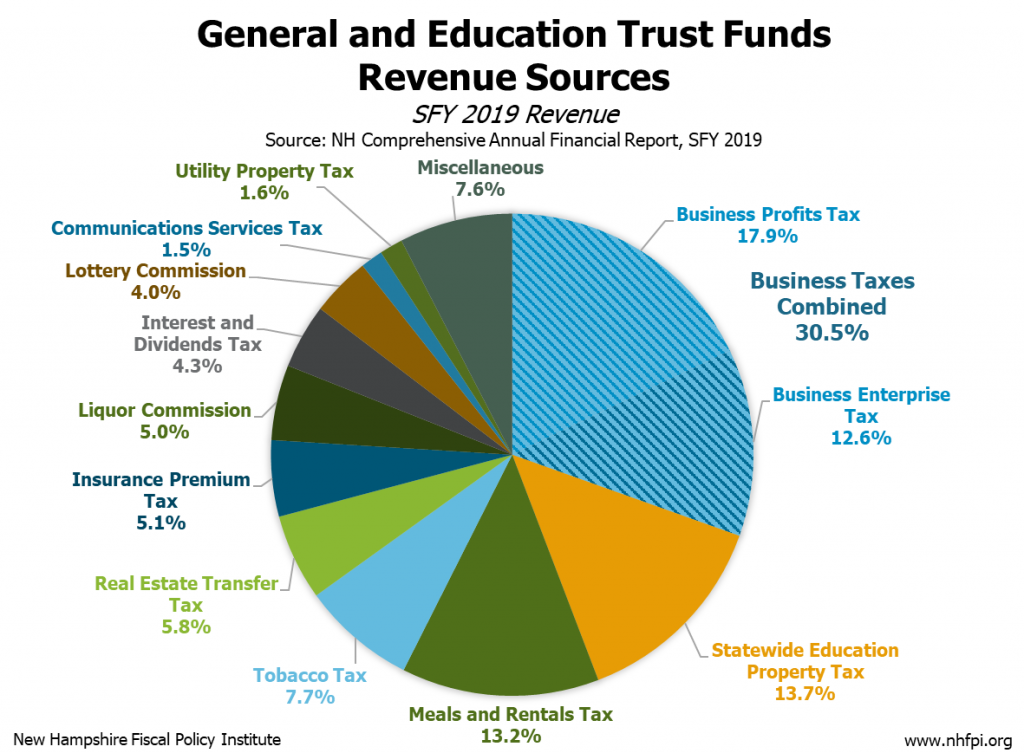

Early Impacts Of The Covid 19 Crisis On State Revenues New Hampshire Fiscal Policy Institute

Once the buyer resells the meals it must collect and remit meals tax to the Department of Taxes.

. 2 NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION MEALS RENTALS TAX BOOKLET GENERAL INFORMATION MR General Info Rev 122015 FORM MR General Information MR TAX LICENSE REQUIREMENT The MR Tax is a tax assessed upon patrons of hotels restaurants and renters of motor vehicles based on the. 2022 New Hampshire state sales tax. This new system will replace our current e-file system for Real Estate Transfer Tax counties DP-4 payments as of January 1 2022.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Date of filing is the date this form is either hand delivered to the municipality postmarked by the post office or receipted by an overnight delivery service. Some tax discounts are available to small brewers.

File this form at least 30-days prior to the start of business or the expiration date of the existing license. WHERE TO FILE Mail to. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a New Hampshire Meals Tax Restaurant Tax. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where meals are served the holder of the license is. If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920.

There are however several specific taxes levied on particular services or products. New Hampshire is one of the few states with no statewide sales tax. File this form at least 30-days prior to the start of business or the expiration date of the existing license.

Follow the step-by-step instructions below to eSign your nh dp14. Decide on what kind of eSignature to create. MEALS RENTALS TAX RETURN Instructions Meals Rental Operators may file electronically on the Departments website at wwwrevenuenhgovgtc.

Once the form is accepted the restaurant doesnt have to collect and send the sales tax on meals to the Commonwealth. CHECK the AMENDED RETURN box if you are filing to make changes or corrections to a previously filed DP-14 for any ONE taxable period. A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency.

This means that we dont yet have the updated form for the current tax yearPlease check this page regularly as we will post the updated form as soon as it is released by the New Hampshire Department of Revenue Administration. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Exact tax amount may vary for different items.

After that your nh meals and rooms tax form is ready. NH DRA PO Box 454 Concord NH 03302-0454. A restaurant that sells meals to a restaurant meal delivery company must accept a Massachusetts Sales Tax Resale Certificate Form ST-4 from that restaurant meal delivery company.

The meals tax rate is 625. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. 107 - 340 per gallon or 021 - 067 per 750ml bottle depending on alcohol content.

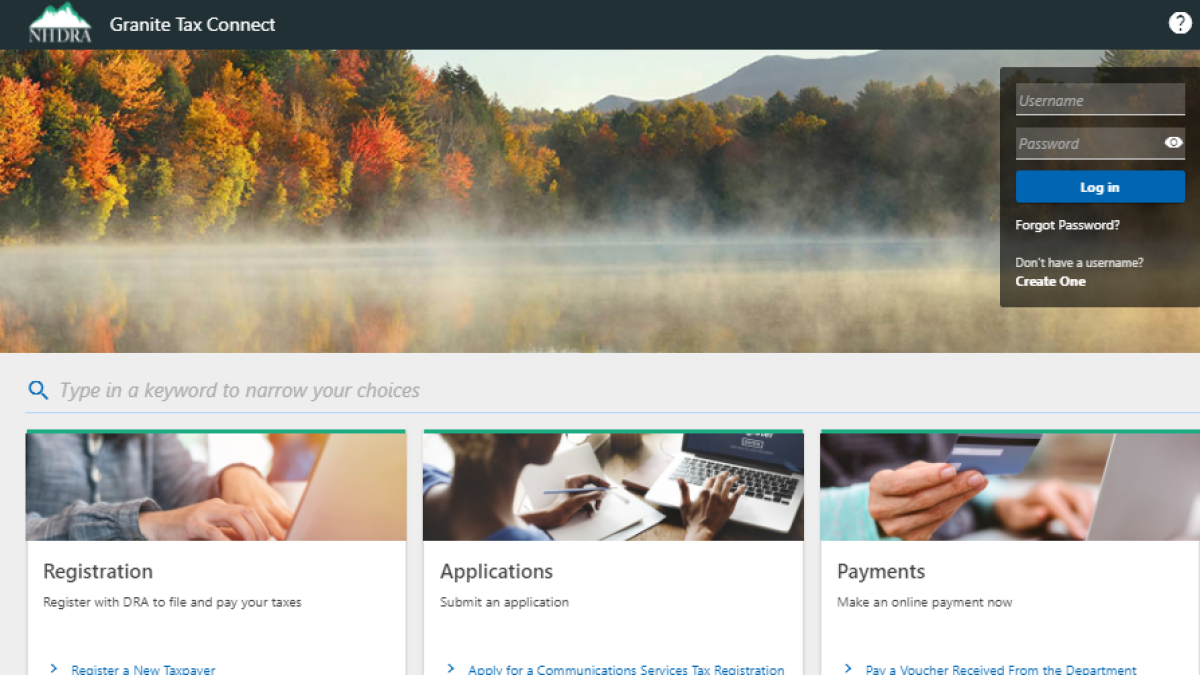

There are three variants. For additional assistance please call the Department of Revenue Administration at 603 230-5920. Filing options - Granite Tax Connect.

The Meals and Rentals MR Tax was enacted in 1967. The MR Tax is paid by the consumer and is collected and remitted to the State on the 15th of each month by operators of hotels restaurants or other businesses providing. Please visit GRANITE TAX CONNECT to create or access your existing account.

603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301. Rentals Tax and follow the prompts. A typed drawn or uploaded signature.

Federal excise tax rates on beer wine and liquor are as follows. If you have questions call 603 230-5920. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant.

Be sure to visit our website at revenuenhgovGTC to create your account access today. Forms and Instructions by Tax Type. File this application with the municipality by the deadline see below.

Select the document you want to sign and click Upload. The buyer must present to the seller an accurate and properly executed exemption certificate Form M-3 Vermont Meals Tax Exemption Certificate for Purchases of. The tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants as well as on motor vehicle rentals.

What is the Meals and Rooms Rentals Tax. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. We last updated the 2013 Meals and Rentals Booklet in April 2021 and the latest form we have available is for tax year 2020.

1350 per proof-gallon or 214 per 750ml 80-proof bottle. Create your eSignature and click Ok. NH DRA PO Box 454 Concord NH 03302-0454.

A New Hampshire Meals Rentals Tax License must be obtained prior to the start of business and renewed by June 30 of each odd-numbered year. The notice of tax means the date the board of tax and land appeals BTLA determines the. A proof gallon is a gallon of liquid that is 100 proof or 50 alcohol.

Tax Returns Payments to be Filed. File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT.

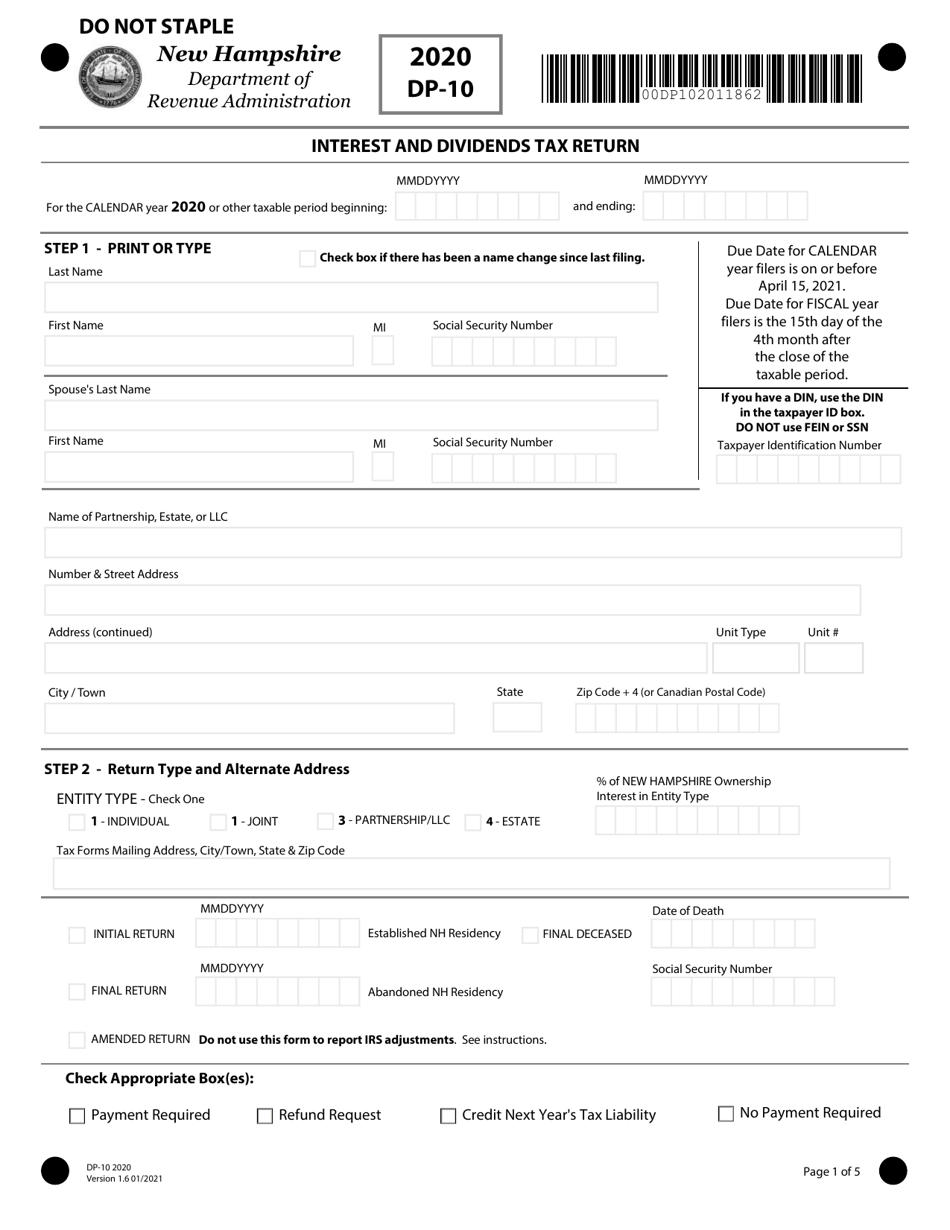

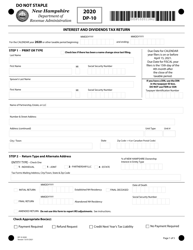

Form Dp 10 Download Fillable Pdf Or Fill Online Interest And Dividends Tax Return 2020 New Hampshire Templateroller

Function Agreement Restaurant 45 Agreement Function Room Function

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

New Hampshire Meals And Rooms Tax Rate Cut Begins

Facilities Campground Crow S Nest Lake Sunapee

Keene Nh Pumpkin Festival So Many Pumpkins Lit All At Once World Records Baby Pumpkin Lights Pumpkin Festival World

Hoss And Mary S In Maine Makes Incredible Burgers The Incredibles Maine Mary

Catering Event Order Form Template Luxury Banquet Event Order Sample Google Search Event Planning Guide Event Event Planning Printables

Download Instruction For Cd 3 Application For Meals Amp Rentals Tax Operators License Pdf 2019 Templateroller

Form Dp 10 Download Fillable Pdf Or Fill Online Interest And Dividends Tax Return 2020 New Hampshire Templateroller

New Hampshire Legislation Reduces Corporate Taxes Eliminates Personal Income Tax Albin Randall And Bennett

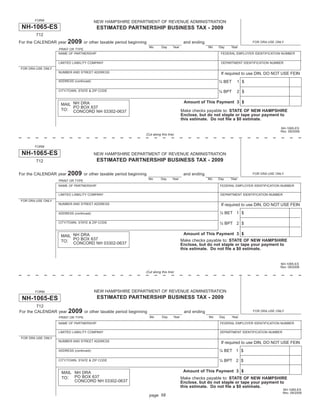

Estimated Partnership Business Tax Quarterly Payment Forms

Form Dp 10 Download Fillable Pdf Or Fill Online Interest And Dividends Tax Return 2020 New Hampshire Templateroller

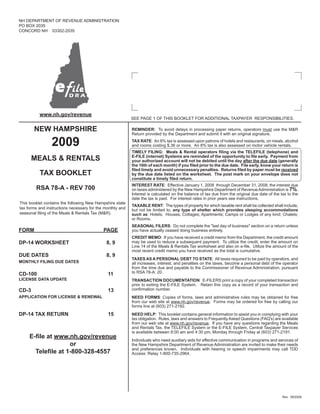

Meals Rentals Tax Booklet 2009

New Hampshire Revenue Dept Launches Final Phase Of Tax System

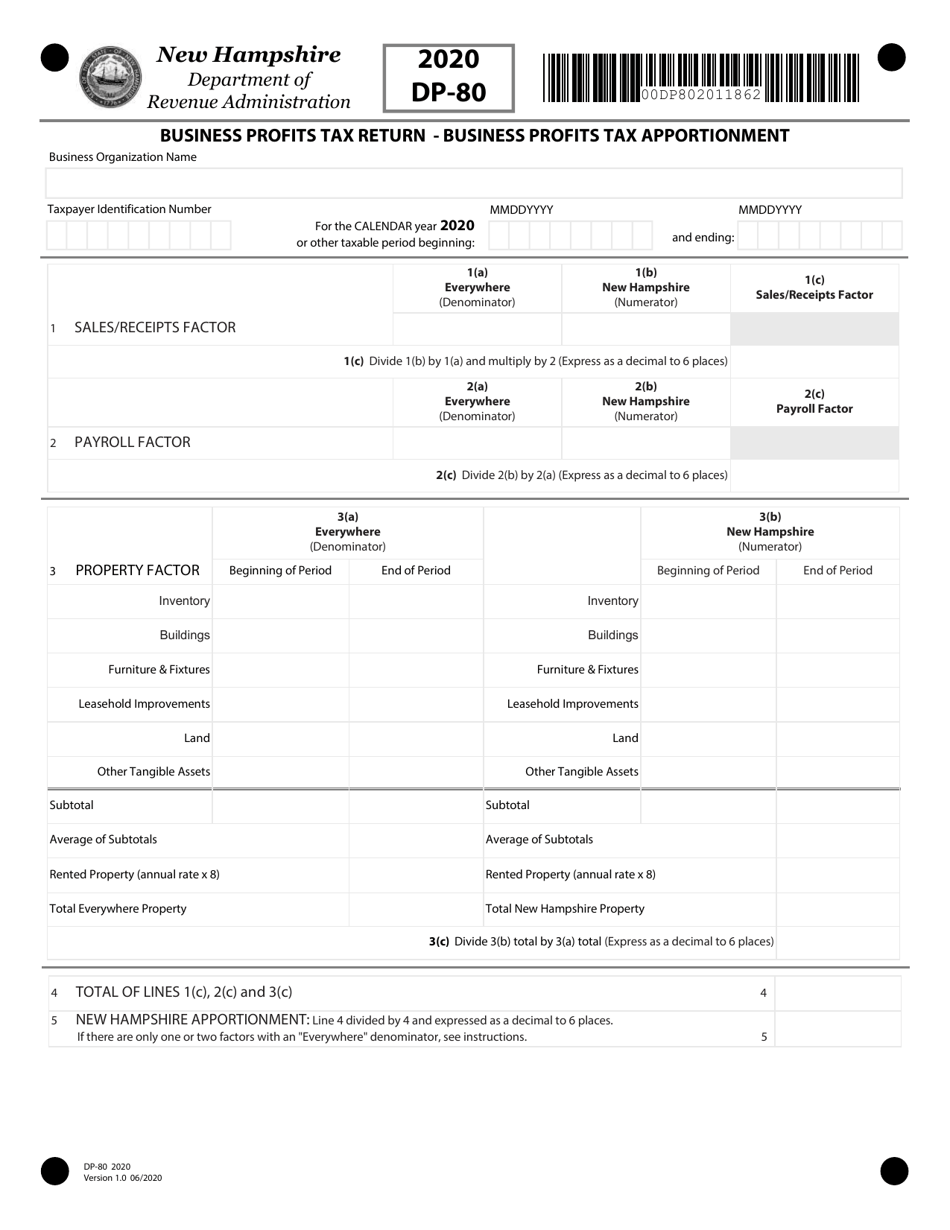

Form Dp 80 Download Fillable Pdf Or Fill Online Business Profits Tax Return Business Profits Tax Apportionment 2020 New Hampshire Templateroller

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Retirement Tax States

2010 Form Nh Dor Dp 14 Fill Online Printable Fillable Blank Pdffiller